Protect Your Records – Closing Your QuickBooks

Once you have entered all prior year activity and reconciled all accounts, you want to prevent mistaken prior year typos by closing your QuickBooks. This is an easy step that your tax accountants and auditors will appreciate and saves you from potential headaches of trying to find the accidental changes to closed periods the following year. Here are the steps for QuickBooks Desktop:

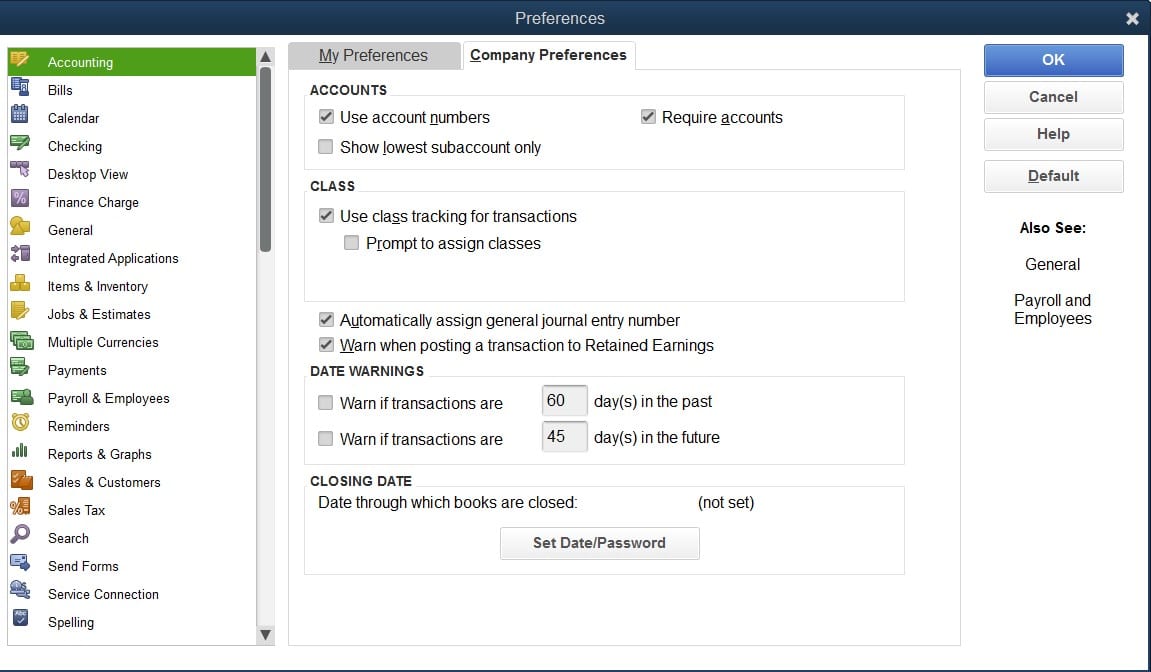

Go to Edit > Preferences – Go to the Accounting tab on left & Company Preferences tab on top:

Click Set Date/Password > Enter the Closing Date and Closing Date Password > Click OK

You can do this monthly or quarterly too, but at a minimum perform annually!

You Closed Your Books But Need To Adjust Estimates

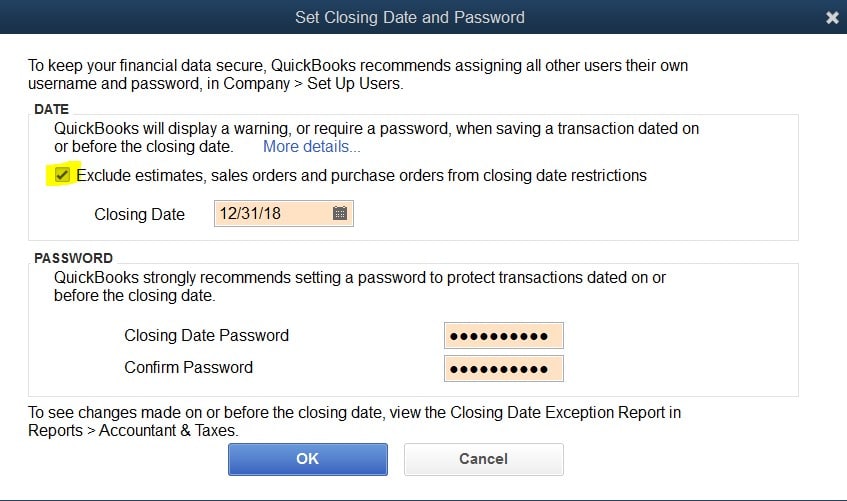

Applies to QuickBooks Desktop/Enterprise:

To maintain access to prior estimates, sales orders and purchase orders check the box above the closing date.

Go to Edit > Preferences – Go to the Accounting tab on left & Company Preferences tab on top:

Click Set Date/Password > Check the box above the Closing Date > Click OK

Keep rolling without fear of affecting prior year!

Protect Your Records – Close Your Books In QuickBooks Online, Too

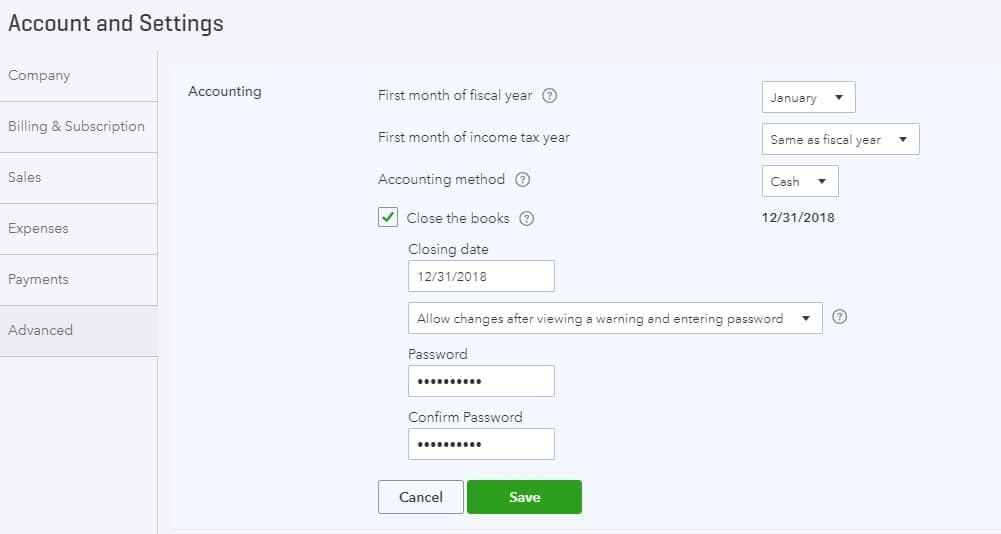

Ensure all activity is entered and reconciled then follow the below steps to prevent accidental changes to closed periods. Here are the steps for QuickBooks Online:

Go to the Gear icon in the top right > Account and Setting > Advanced tab on left at bottom.

Within the top Accounting section, click the pencil at top right to edit.

Enter the updated closed period, chose ‘Allow changes after viewing a warning and entering a password’ and enter your password and click Save.

Year-end headaches averted!

Any questions give Chortek’s QuickBooks Specialist, Ann Weaver, a call @ 262.522.8277