Preparing for Year-End and Tax Season

What should you be thinking about for your business when you get close to the end of the year?

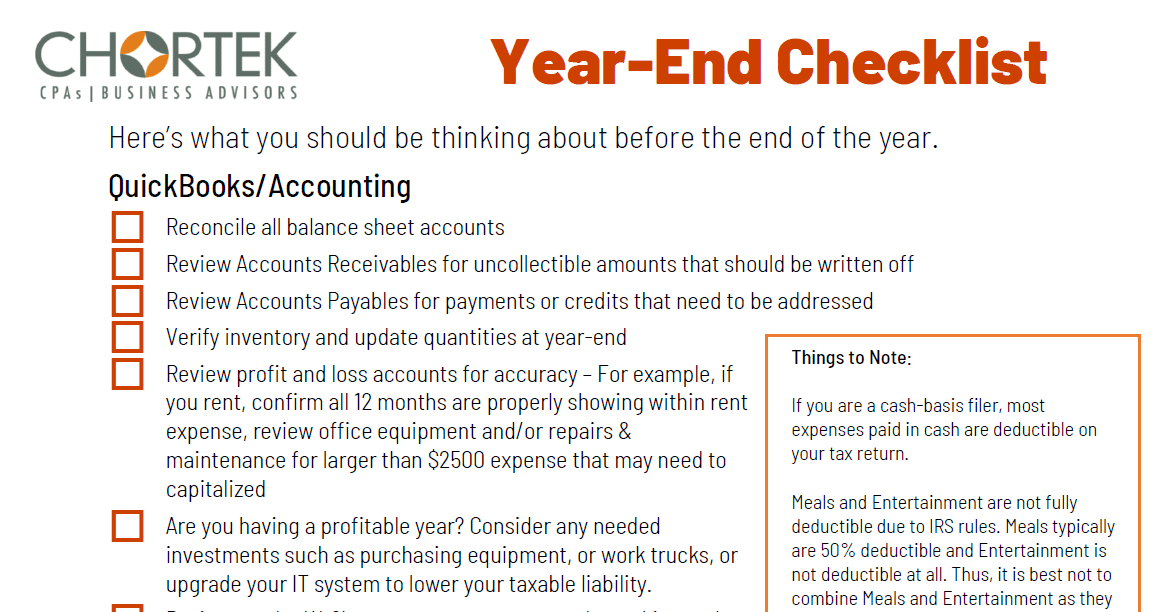

The year end is quickly approaching, and it’s never too early to be preparing for year-end and tax season. You should use a checklist to make sure you’re ready for year-end and tax season. What should you be thinking about from a QuickBooks and accounting perspective, versus a payroll and HR perspective? Download Chortek’s free checklist to get started.

Preparing for year-end now and getting a good review of your year thus far, before it ends, allows you to connect with your tax accountant and provide good information. This updated information can lead your CPA or accountant to potentially provide guidance. They can help you make decisions that minimize your tax liability, and prepare for future plans.

Please use this list as a guide to assist in your planning for year-end. You can also reach out for further assistance along the way. Chortek is here to help pave the way to a smooth tax season.