401(k) Plan Audit & Consulting

Great teams have great plans for their future

401(k) plans are essential to many people’s retirement goals. When an employer-sponsored plan is easily understandable and accessible, it becomes a powerful tool for building and retaining a great team. Whether you are ready for an audit or simply want another set of eyes on your plan, we can help ensure you are putting your best 401(k) plan forward.

401(k) Plan Audit & Consulting

Great teams have great plans for their future

401(k) plans are essential to many people’s retirement goals. When an employer-sponsored plan is easily understandable and accessible, it becomes a powerful tool for building and retaining a great team. Whether you are ready for an audit or simply want another set of eyes on your plan, we can help ensure you are putting your best 401(k) plan forward.

What is a 401(k) audit? And when do you need one?

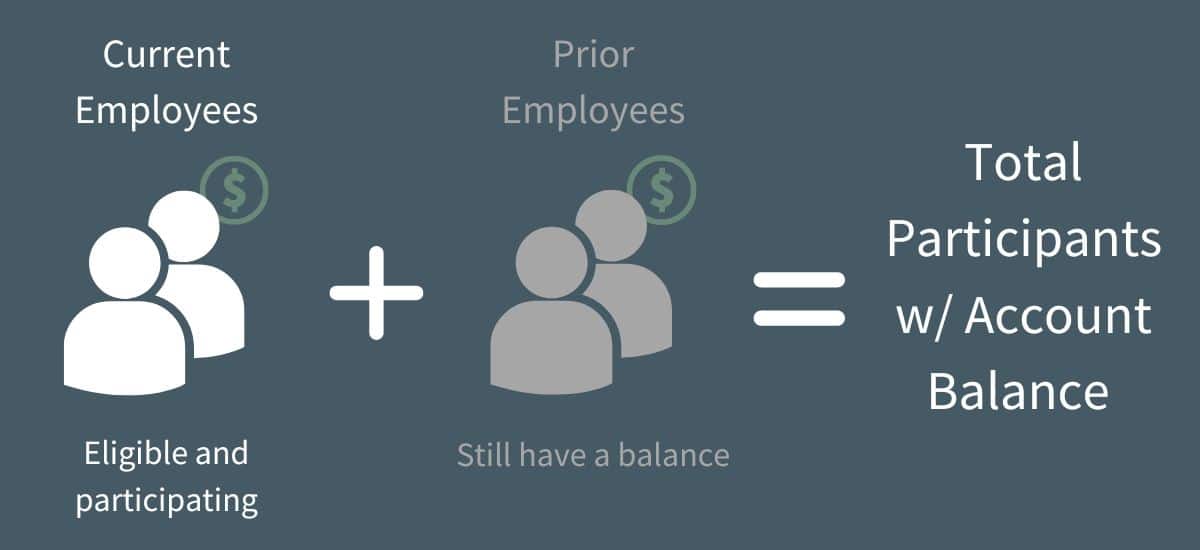

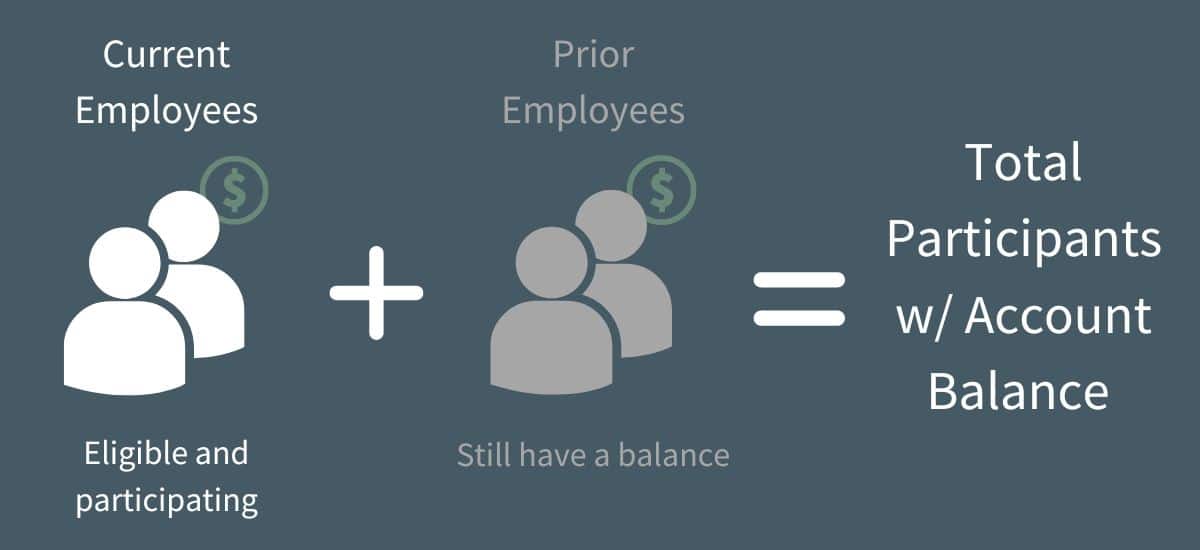

Simply put, a 401(k) audit ensures your plan is healthy and compliant. We can help you evaluate your plan at any time, but the Department of Labor requires an audit once you reach 100 participants with account balances. And 100 includes both current employees and prior employees.

What is a 401(k) audit? And when do you need one?

Simply put, a 401(k) audit ensures your plan is healthy and compliant. We can help you evaluate your plan at any time, but the Department of Labor requires an audit once you reach 100 participants with account balances. And 100 includes both current employees and prior employees.

Our expertise

Sometimes knowledge is everything

Auditing is definitely one of those times. There is no such thing as a cookie-cutter audit. It takes specialized training and experience to be able to drill down into the nuts and bolts of how a plan is structured and functioning. That’s why we stick to 401(k) plans. It gives us the focus we need to keep our skills sharp.

Employee Benefit Plan Audit Quality Center

Our membership gives us access to the latest auditing tools and resources.

High marks from our peers

Our work routinely clears required peer review audits.

Specialized training

Our team stays up to date on the latest techniques and regulations.

Our expertise

Sometimes knowledge is everything

Auditing is definitely one of those times. There is no such thing as a cookie-cutter audit. It takes specialized training and experience to be able to drill down into the nuts and bolts of how a plan is structured and functioning. That’s why we stick to 401(k) plans. It gives us the focus we need to keep our skills sharp.

Employee Benefit Plan Audit Quality Center

Our membership gives us access to the latest auditing tools and resources.

High marks from our peers

Our work routinely clears required peer review audits.

Specialized training

Our team stays up to date on the latest techniques and regulations.

Our process

With great expertise comes great efficiency

Audits aren’t fun. While we love what we do, we know that our work is a necessary disruption to your business. We take pride in our ability to work behind the scenes. In fact, you can grant our team access to your plan provider, and we can run the reports we need for you. This only comes with experience. If we had a motto, it would be: get in, get what we need, get to work!

Our process

With great expertise comes great efficiency

Audits aren’t fun. While we love what we do, we know that our work is a necessary disruption to your business. We take pride in our ability to work behind the scenes. In fact, you can grant our team access to your plan provider, and we can run the reports we need for you. This only comes with experience. If we had a motto, it would be: get in, get what we need, get to work!

Consulting Services

Don’t let employee benefits become an employer burden

Even if your 401(k) plan doesn’t require an audit, we can help you better understand the rules and regulations that come along with what you offer your employees. While we don’t sell investments or plan administration services, we can listen to your pain points and evaluate your plan document. This will allow us to present you with recommendations on how to simplify your plan.

Here are some of the things we can help you with:

-

Review plan document and operations

-

Review deposits of employee deferrals and sponsor contributions

-

Evaluate compliance testing results

-

Coordinate with the Department of Labor to resolve any issues that result in a notice

Consulting Services

Don’t let employee benefits become an employer burden

Even if your 401(k) plan doesn’t require an audit, we can help you better understand the rules and regulations that come along with what you offer your employees. While we don’t sell investments or plan administration services, we can listen to your pain points and evaluate your plan document. This will allow us to present you with recommendations on how to simplify your plan.

Here are some of the things we can help you with:

Review plan document and operations

Review deposits of employee deferrals and sponsor contributions

Evaluate compliance testing results

Coordinate with the Department of Labor to resolve any issues that result in a notice

Related Resources

Your resource for more information on tax strategy and accounting best practices.